Wednesday, October 1, 2014

3 Reasons To Invest In Gold (Video)

Unknown

9:29 AM

bank of england

,

Brazil

,

China

,

finance

,

Germany

,

India Gold Buying

,

LBMA

,

moneywatch

,

QE1

,

QE2

,

QE3

,

Ukraine

,

United Kingdom

,

United states

,

US Dollars

,

Vietnam

No comments

:

"The World Considers Gold as Money, and China actually promotes it as money and has cornered the market."

"Gold will be responsible for the biggest wealth transfer (from West to East) in ALL OF HUMAN HISTORY."-Alasdair Macleod

"The three biggest reasons to invest in gold" In this 2nd of a series of London interviews that Lars Schall conducted for Matterhorn Asset Management this summer, Lars has a City street conversation with Alasdair Macleod. Together they talked about, inter alia: the challenges for the LBMA; China's appetite for gold; the Shanghai Cooperation Organization as the player in the gold market in the future; and the problems related to Germany's gold at the New York Fed. Alasdair Macleod started his career as a stockbroker in 1970 on the London Stock Exchange, and learned through experience about things as diverse as mining shares and general economics. Within nine years Macleod had risen to become a senior partner at his firm. He subsequently held positions at director level in investment management, fund management and banking. For most of his 40 years in the finance industry, Macleod has been de-mystifying macro-economic events for his investing clients. The accumulation of this experience has convinced him that unsound monetary policies are the most destructive weapons that governments can use against the people. Accordingly, his mission is to educate and inform the public, in layman’s terms, what governments do with money and how to protect themselves from the consequences.

Friday, September 26, 2014

Did A Little Video Digging (Video)

Unknown

8:37 AM

bearish economy

,

Brazil

,

buy gold

,

buy silver

,

buying gold online

,

China

,

France

,

Germany

,

india

,

Ireland

,

Ukraine

,

United Kingdom

,

United states

,

Vietnam

No comments

:

Happy Friday Guys.

With US Stocks out performing all other markets, US currency setting itself up for hyperinflation, and precursors to world conflict--These seems like the perfect time now to be in the gold buying market.

I went digging in the YouTube archives and found this GEM.

This interview was done about 4 years ago--and his predictions are about spot on. Jim Rogers and the rest of the world agree that within the next few years gold will be on the rise. It is usually coveted and bought when the world is in turmoil--which it is now.With US Stocks out performing all other markets, US currency setting itself up for hyperinflation, and precursors to world conflict--These seems like the perfect time now to be in the gold buying market.

Do You Have YOUR Gold?

Thursday, September 25, 2014

Is Marc Faber On To Something...? (Videos)

Unknown

10:36 AM

bearish economy

,

benjis

,

buying gold online

,

death of the dollar

,

dollar bills

,

financial future

,

gold buyer

,

Gold futures

,

india

,

India Gold Buying

,

making money

,

making money online

No comments

:

Hey guys,

Quick Video here from an snippet of a CNBC video with Gloom, Boom & Doom's Marc Faber and his view on the worlds stocks.

He makes some great points.

Here Marc speaks with Bloomberg on how the markets are responding to the current global events. This just makes sense to pay attention to.

Quick Video here from an snippet of a CNBC video with Gloom, Boom & Doom's Marc Faber and his view on the worlds stocks.

He makes some great points.

Here Marc speaks with Bloomberg on how the markets are responding to the current global events. This just makes sense to pay attention to.

Wednesday, September 24, 2014

5 Time Management Secrets To Being Stress-Free

Unknown

5:04 PM

Bloomberg

,

buy silver

,

death of the dollar

,

india

,

skill set

,

time management

No comments

:

Ok. Let's break from the doom & gloom. Everybody gets a little bogged down with their everyday from time to time and need ways to keep their head above water. What do YOU do to stay sane?

Below are are 5 Time Management Secrets To Being Stress Free. Enjoy.

We all have the same 24 hours in a day. None of us can steal a minute here or there to get extra time. We all get the same 24 hours, the same 1440 minutes, and the same 86,400 seconds in a day.

In spite of that, many of us fret over time. We complain about the lack of time, and there are many who have written about time. “Time is money,” is a famous adage. Motivational speaker, Michael Altshuler, has said, “The bad news is time flies. The good news is you’re the pilot.”

The fact is, like it or not, we are all time managers, and the time we manage—or fail to manage—is ours and ours alone. I hear my clients complain frequently about never having enough time to do what they need to do. They have a never-ending list of tasks that never seem to get completed because they don’t have “time.” And while they fret about it, their level of stress mounts.

What’s the solution? Perhaps we need to take heed of what Michael Altshuler says: “You are the pilot of your time.” You are, in fact, the only person who can decide how to spend your time. If time management is stressing you out, here are five time management secrets to becoming less stressed if not completely stress-free.

1. Assess where you are spending (wasting?) your time.

When you need more money, you take a look at your financial budget, right? You figure out where the money is going, and then you figure out how to cut back on some things so you will have more money to spend on other things. Use this same strategy with time.

Create a time budget. Make a list of all the things you spend time doing in a day. Don’t forget to include things like updating your Facebook status, posting on Twitter, pinning on Pinterest, networking on LinkedIn, and talking on the phone. You get the idea.

Track your time for a few days in a time journal and be honest with yourself. Are you going down the Facebook rabbit hole for too long each day? It is way easy to do. Limit yourself to a specific amount of time every day for social media. If something critical happens to one of your friends or a member of your family, you will get a call… you won’t need to learn it on Facebook.

2. Limit the time you spend on e-mail.

I don’t know about you, but I get an inordinate amount of junk e-mail. It’s worse than the paper junk mail because I know to throw that stuff away. But somehow, an e-mail carries with it a greater sense of importance and urgency. I hate having unopened e-mail in my in-box. Not that I ever read it all… but I will check to make sure I don’t need to read it, and then I check it as “read.” Periodically, I get tough and start unsubscribing from e-mail suppliers that are bad about sending me junk.

If that strategy doesn’t work for you, create folders and place your less urgent messages in the folders for later. Don’t let e-mail become your time drain, however. It’s far too easy to do. You can start checking e-mail, and suddenly an hour has slipped away and you haven’t gotten started on the list of things you want to accomplish for the day.

3. Plan your day.

Having a plan for what you want to accomplish each day is important. Will everything go the way you planned? Probably not. So plan, but be flexible. It is a good idea to approach each day with a sense of purpose. Set goals for getting one, two or three specific things accomplished each day. As you accomplish each thing, give yourself a little cheer or a silent pat on the back. If you are a list maker, check it off your list, but don’t get compulsive about it. If you have to defer one of the things on your list until tomorrow because something more urgent came up today, that’s okay. You can handle that. There is always tomorrow.

4. Do one thing at a time.

I know, I know, you are thinking “Whaaat? Limit myself to only ONE thing at a time when I could multi-task!?!” The answer is “YES!” The truth is you are not good at multi-tasking even though you may think you are. You can only do one thing at a time if you hope to do it well. You will feel less stressed; you will be far more efficient, and you will have accomplished a lot more in less time if you focus on just one thing at a time. Trust me on this.

5. Avoid getting sucked into the office drama or politics.

Stay away from the office drama kings and queens…you know the ones I mean… they are always ready to dish on the co-worker down the hall. They know the latest on why the boss has been called to headquarters. They are always “in the know” and they are always only too willing and ready to fill you in. The trouble with these individuals is that they will also “share” information with others about you and your personal business if you are foolish enough to divulge things that they don’t need to know. If you need a confidant, find someone outside the office and steer clear of the people who generate upset around the office. They are a time drain for sure.

The main thing to remember about time management is what I offered at the beginning of this article. We all have the same amount of time. Some people seem to accomplish more with their time than others, but they didn’t find an extra hour somewhere or build in an extra couple of weeks to get ahead of the rest of us. We all have the same 24 hours in a day and the same 365 days a year. You may feel like time is slipping away from you, but the fact is you ARE the pilot of your time, and you CAN take control of it… starting right now.

Read more atfree/#Ub7URyfZQs0JfIoH.99

Tuesday, September 23, 2014

Economic Recovery On The Horizon? 3 Stats To Watch

Unknown

11:30 AM

bearish economy

,

employment

,

home building

,

home buying

,

housing market

,

manufacturing

,

recession

,

unemployment rate

,

US Dollars

No comments

:

Article from: CNN MONEY

There is so much data on the economy now, it is hard to figure out what is most important. Last week alone exemplified the flood of numbers: the Census Bureau, Federal Reserve and Labor Department released a variety of economic data points.

The big news makers -- employment, inflation and gross domestic product -- are always important statistics, but if you really want to know where things are headed, there are a few lesser known indicators that give a fuller picture of the economy's health.

To make some sense of it all, CNNMoney surveyed numerous economists. According to the experts, keep an eye on these three things.

1. People's spending: Shoppers have a big impact on the economy. Consumption makes up over two-thirds of the America's gross domestic product. The Great Recession made people a lot more cautious about buying things. And when people aren't buying, that also hurts company profits and jobs.

"You can't sustain strong economic growth without the consumer leading the way," said Sal Guatieri, senior economist at BMO Capital Markets in Toronto.

The question is whether buying is back.

The best way to gauge that is the monthly Personal Consumption Expenditures (PCE) index.

At the height of the recession in 2009, PCE decreased, and it still is not back to its pre-recession levels.

What most economists -- and businesses -- want to see is steadily increasing spending. But so far in 2014, there have been three months where PCE has dropped, including July. That's worse than 2013 where the PCE increased (or at least remained level) every month.

Bottom line: Not back yet

To make some sense of it all, CNNMoney surveyed numerous economists. According to the experts, keep an eye on these three things.

1. People's spending: Shoppers have a big impact on the economy. Consumption makes up over two-thirds of the America's gross domestic product. The Great Recession made people a lot more cautious about buying things. And when people aren't buying, that also hurts company profits and jobs.

"You can't sustain strong economic growth without the consumer leading the way," said Sal Guatieri, senior economist at BMO Capital Markets in Toronto.

The question is whether buying is back.

The best way to gauge that is the monthly Personal Consumption Expenditures (PCE) index.

At the height of the recession in 2009, PCE decreased, and it still is not back to its pre-recession levels.

What most economists -- and businesses -- want to see is steadily increasing spending. But so far in 2014, there have been three months where PCE has dropped, including July. That's worse than 2013 where the PCE increased (or at least remained level) every month.

Bottom line: Not back yet

2. Home buying and building: The housing collapse was at the center of the recession. The slow recovery of the housing market serves as a microcosm of the economy's tepid comeback.

"Home ownership has historically been the single largest trigger to consumer spending," said Diane Swonk, chief economist at Mesirow Financial in Chicago.

People who buy homes tend to buy more of other products than non-buyers, which suggests that home buying can trigger a positive ripple effect on personal spending and jobs, Swonk says.

Economists are watching a data point known as "housing starts."

Single-family housing starts in July numbered 656,000, or about 10% higher than the same time last year, according to the Census Bureau. Still, the number of these housing starts is 50% below a typical level, says Robert Denk, senior economist at the National Association of Home Builders in Washington D.C.

A more normal level of housing starts would be about 1.3 million, the average between 2000 and 2003, Denk says.

"The recovery truly can't be considered complete until housing gets back on track," Denk says. "[Housing] generates jobs and it still really is that sector of the economy that hasn't fully recovered, in fact it's only halfway back."

Bottom line: Not back yet

3. Manufacturing: America might be known for Silicon Valley more than steel these days, but the country still makes a lot of products.

Another indicator that holds implications for the greater economy is the PMI, an acronym for the wonky-sounding Purchasing Managers' Index (that term was actually abandoned in 2001). Created by the Institute for Supply Management, the PMI gauges manufacturing levels across the country, taking several factors into consideration, including employment and inventory levels.

In a positive sign for the recovery, the PMI hit a 12-month high in August at 59%, according to ISM. The average PMI at the recession's peak in 2009 was 46.4%. Thus far in 2014, the PMI has averaged 54.9%, signaling a healthy gain in manufacturing during the recovery.

There are some concerns that the really strong U.S. dollar could hurt manufacturing, since it makes American goods a lot more expensive to people in Europe and other parts of the world, but so far there doesn't seem to be an impact.

"Home ownership has historically been the single largest trigger to consumer spending," said Diane Swonk, chief economist at Mesirow Financial in Chicago.

People who buy homes tend to buy more of other products than non-buyers, which suggests that home buying can trigger a positive ripple effect on personal spending and jobs, Swonk says.

Economists are watching a data point known as "housing starts."

Single-family housing starts in July numbered 656,000, or about 10% higher than the same time last year, according to the Census Bureau. Still, the number of these housing starts is 50% below a typical level, says Robert Denk, senior economist at the National Association of Home Builders in Washington D.C.

A more normal level of housing starts would be about 1.3 million, the average between 2000 and 2003, Denk says.

"The recovery truly can't be considered complete until housing gets back on track," Denk says. "[Housing] generates jobs and it still really is that sector of the economy that hasn't fully recovered, in fact it's only halfway back."

Bottom line: Not back yet

3. Manufacturing: America might be known for Silicon Valley more than steel these days, but the country still makes a lot of products.

Another indicator that holds implications for the greater economy is the PMI, an acronym for the wonky-sounding Purchasing Managers' Index (that term was actually abandoned in 2001). Created by the Institute for Supply Management, the PMI gauges manufacturing levels across the country, taking several factors into consideration, including employment and inventory levels.

In a positive sign for the recovery, the PMI hit a 12-month high in August at 59%, according to ISM. The average PMI at the recession's peak in 2009 was 46.4%. Thus far in 2014, the PMI has averaged 54.9%, signaling a healthy gain in manufacturing during the recovery.

There are some concerns that the really strong U.S. dollar could hurt manufacturing, since it makes American goods a lot more expensive to people in Europe and other parts of the world, but so far there doesn't seem to be an impact.

Monday, September 22, 2014

Oklahoma Affirms Gold and Silver as Legal Tender

Unknown

2:00 PM

bearish economy

,

benjis

,

buying gold online

,

dollar

,

falling stocks

,

gold

,

gold coins

,

gold heist

,

India Gold Buying

,

QE1

,

QE2

,

QE3

,

Reuters

,

United states

,

US Dollars

No comments

:

On June 4, Oklahoma joined Utah, Texas, and Louisiana in affirming that gold and silver coins are (as they always have been under the Constitution) legal tender in the payment of debts in the state. On the surface this seems almost nonsensical: affirming a right that already exists in Article I, Section 10 of the U.S. Constitution. But it is much more than that.

Senate Bill 862, which Oklahoma Governor Mary Fallin signed into law this week, says,

Gold and silver coins issued by the United States government are legal tender in the State of Oklahoma.No person may compel another person to tender or accept gold or silver coins that are issued by the United States government, except as agreed upon by contract.

The new law also exempts all state-level taxes that Oklahoma residents would otherwise have to pay when exchanging gold or silver back into paper money:

For taxable years beginning on or after January 1, 2015, there shall be exempt from Oklahoma taxable income, or in the case of an individual, the Oklahoma adjusted gross income, any amount of net capital gains ... which result from the sale or exchange of gold or silver for another form of legal tender.

All this appears to do is affirm the language from the U.S. Constitution: "No state shall ... make any Thing but gold and silver Coin a Tender in Payment of Debts."

But it does much more. Sean Fieler, Chairman of American Principles in Action, one of the bill’s primary supporters and promoters, came close to explaining why:

I commend the people of Oklahoma, particularly Senator Clarke Jolley and Governor Mary Fallin, for asserting their state’s constitutional right to declare gold and silver legal tender.

With the Federal Reserve actively suppressing interest rates and eroding the purchasing power of the U.S. dollar, it is welcome news to see one more state give its citizens free access to money that holds its value over time.

It’s about options. When citizens become comfortable with using money that retains its value over time, it will mark the beginning of the end of paper currency backed by nothing. This would be the inevitable end point of the process that began on August 15, 1971 when then-President Richard Nixon unilaterally ended the dollar’s convertibility into gold. For the past 43 years the world has been subjected to floating currencies pegged to nothing other than future promises to pay in more paper money. As Ron Paul noted in his book The Case for Gold, first published in 1982,

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. But [today’s] government bonds are not backed by tangible wealth [but] only by the government’s promise to pay out of future tax revenues....

In the absence of a gold standard, there is no way to protect savings from confiscation through inflation....

This is the shabby secret of the welfare states’ tirades against gold. [Unlimited] deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process.

Paul was referring to the "shabby secret" revealed by former Federal Reserve Chairman Alan Greenspan before he was assimilated by the monetary Borg of the Federal Reserve. In July of 1966, Greenspan wrote in Gold and Monetary Freedom about that secret:

In the absence of a gold standard there is no way to protect savings from confiscation through inflation. There is no safe store of value....

If everyone decided, for example, to convert all his [paper] bank deposits to silver [or gold] ... bank deposits would lose their purchasing power and government-created bank credit would be worthless....

This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the “hidden” confiscation of wealth. Gold stands in the way of this insidious process....

If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.

That confiscation has been accelerating exponentially since 1971, as seen by clicking here to view price levels in the United States from 1965 through 2013. Once the gold standard was abandoned by Nixon in 1971, the price level in the United States has risen by a factor of six! Put another way, citizens’ paper money has lost almost 80 percent of its value in just 43 years.

That Oklahoma has joined with other states in its affirmation of gold and silver (with still others considering similar measures) could mark the beginning of the end of the paper machine itself — the Federal Reserve. William H. Greene is an economics professor at New York University’s Stern School of Business. While a seemingly unlikely spokesman for the abolition of the Fed, his view of the coming inevitable end of the Fed is remarkable:

Over time, as residents of the state use both Federal Reserve Notes and silver and gold coins, the fact that the coins hold their value more than Federal Reserve Notes do will lead to a “reverse Gresham’s Law” effect, where good money (gold and silver coins) will drive out bad money (Federal Reserve Notes). As this happens, a cascade of events can begin to occur, including ... an influx of banking business from outside the state ... and an eventual outcry against the use of Federal Reserve Notes for any transactions. [Emphasis added.]

This is most encouraging to the Tenth Amendment Center, which noted, "Once things get to that point, Federal Reserve notes would become largely unwanted and irrelevant for ordinary people. Nullifying the Fed on a state-by-state level is what will get us there."

That’s what makes Oklahoma’s affirmation of a right so important. If every state would affirm their rights under Article I, Section 10, the end of the Fed would merely be a matter of time. Federal Reserve Notes would become irrelevant — a relic of a failed statist experiment in organized, sophisticated theft.

Friday, September 19, 2014

Funny Money

Unknown

6:21 AM

art

,

benjis

,

buying gold online

,

death of the dollar

,

dollar bills

,

drawings

,

financial future

,

five dollar bills

,

funny

,

humor

,

money

,

sketches

,

ten dollar bills

,

US Dollars

No comments

:

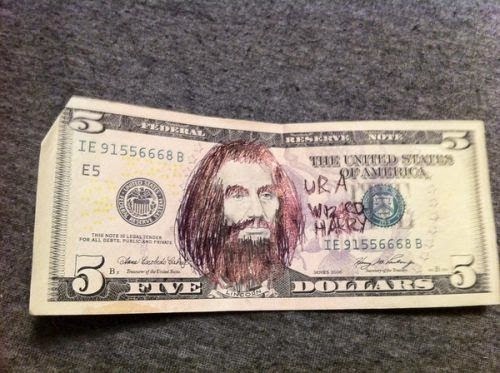

#HappyFriday guys. Thought that these currency sketches could bring some humor into all that's going on in today's economy. Check these out and enjoy.

|

| KI$$. |

|

| George...On The Run? |

|

| Five Dollar Bill Murray. |

|

| Lincoln Without The Hat |

|

| PATRICK! |

|

| Captain Washington. |

|

| It's'A Meee! |

|

| I'm...BATMAN. |

|

| This is either Ozzy or Mona Lisa with shades...eh. |

|

| Einstein! |

|

| The captions on the bills say it all. |

|

| LOL. Excellent. |

|

| G-Dub In King Of Diamonds (Miami) |

|

| A Bathing Lincoln. |

|

| The Euros Power Readings Are Off The Charts! |

|

| Really? |

|

| What Does Marcellis Wallace Look Like? |

|

| Abe LINKoln. |

|

| Don Juan Benjamin. |

|

| Daredevil |

|

| Krusty Washington |

|

| Episode 10. Attack of the FIAT Currency. |

|

| The Official Currency Of Congress |

|

| Abe The Bounty Hunter |

|

| This Benji Is Brought To You By Corporate America. |

-TDD

Subscribe to:

Posts

(

Atom

)